Introduction

Imagine this world: all countries, all banks, all businesses taking one currency: Bitcoin. No more fiat-to-fiat exchange. No more independent domestic monetary policy anymore. One global digital currency for everybody. How would it be?

This is not just a thought experiment. It has real implications—economic, political, social, technological. Some are exciting. Others are deeply worrying. As Bitcoin gains adoption, people increasingly ask: could it ever become the world’s currency? And if it did, what would happen?

This article explores that scenario in depth. We’ll examine what changes, the risks, and whether it might be desirable—or disastrous. Let’s get started.

What Do We Mean by “Global Currency”?

It is necessary, before we go further, to clarify what we are talking about when we use the term “Bitcoin as a global currency.” There are different levels:

- Legal Tender Everywhere: Bitcoin is legally accepted by governments as the official money, like fiat money presently.

- Dominant Reserve Currency: Central banks hold it in reserve; international trade, contracts, and prices refer to it.

- Everyday Medium of Exchange: People use it for wages, shopping, bills, saving.

When we say “global currency,” we are referring to some combination of these: Bitcoin both as reserve standard and day-to-day money everywhere.

The Foundations of Money: What Functions Must a Global Currency Serve

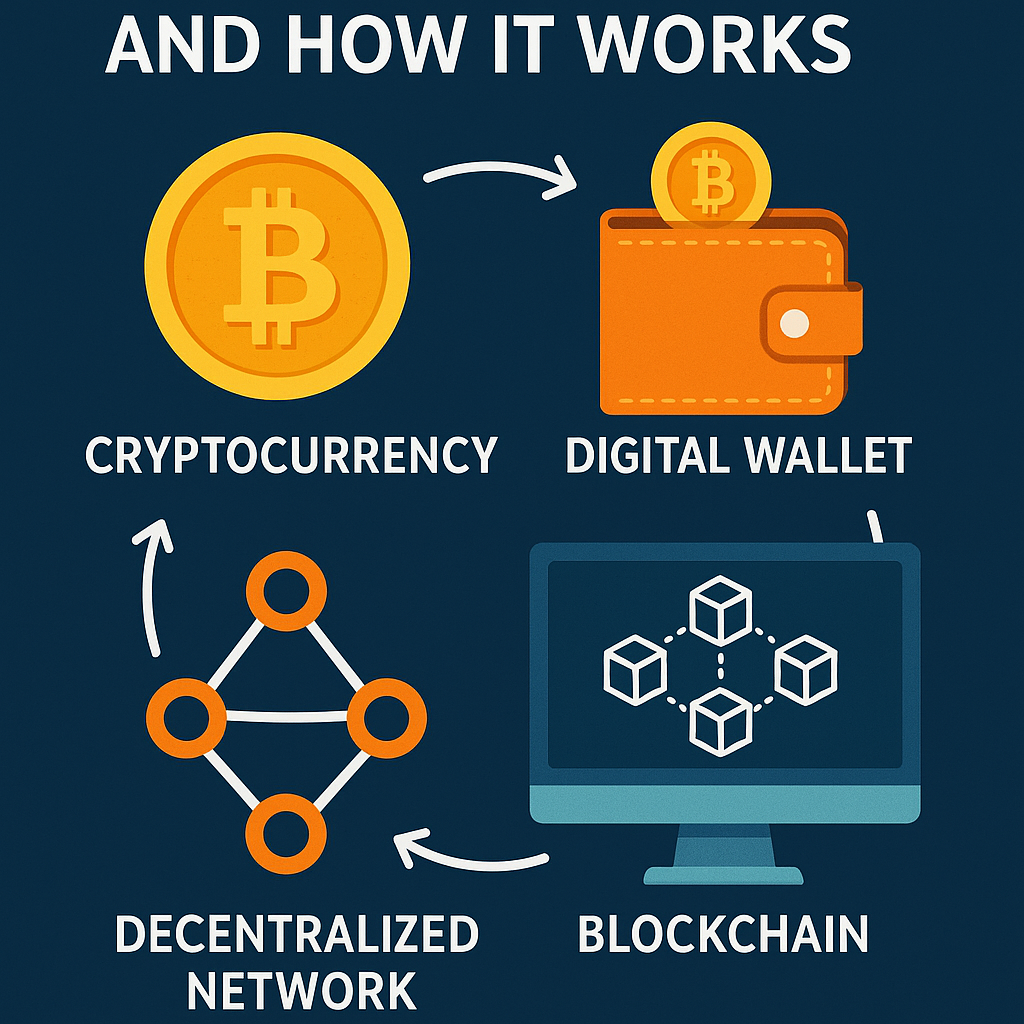

In order to be used around the globe, a currency has to carry out three fundamental functions:

- Medium of Exchange: It has to be accepted commonly, easily transferable, appropriate for daily transactions.

- Store of Value: It should not depreciate over time without massive depreciation.

- Unit of Account: Prices, wages, debts must be representable reasonably stably in its units.

Bitcoin accomplishes some of these already, but not perfectly. It’s widely known, transferable, and not very supplyingly (store of value). It does have its negatives (volatility, scalability, governance) that impact the other uses.

Potential Benefits: What Could Improve If Bitcoin Becomes the World’s Currency

Let’s examine what could happen if Bitcoin is the world currency.

A. Reduction of Currency Conversion Friction

- No Forex Markets: Foreign trade won’t need to have constant exchange between currencies, reducing costs and risks.

- Faster Cross-Border Payments: With Bitcoin, theoretically, you can move value between borders smoother than through banking systems based on intermediaries or correspondent banks.

B. Transparency & Decentralization

- Less Government Manipulation: Fiats allow central banks to print more (i.e. increase supply) and generate inflation. Bitcoin’s limited supply (21 million coins) impose a discipline.

- Decentralized Control: No one controls it. That could reduce risks of monetary policy hijacked by political cycles or actions of desperation.

C. Financial Inclusion

- Unbanked Access: Hundreds of millions with poor or no access to traditional finance could utilize Bitcoin with fewer intermediaries.

- Reduced Remittance Costs: Remittances from migrants back home lose large fractions in fees and exchanges. One international currency might reduce this burden.

D. Hedging Against National Crises

In other countries, fiat money is volatile, inflation is out of control, or there is institutional mistrust. Access to Bitcoin would introduce stability, protecting against hyperinflation or wild devaluation.

E. Global Price Transparency

Global prices in a unified currency would allow straightforward price comparison, purchasing power parity, global terms of trade. Consumers and businesses would better understand true value globally.

Major Challenges & Risks If Bitcoin Becomes the World’s Currency

Of course, there are gigantic barriers. The majority of them are not just technical but political, economic, and social.

A. Volatility

One of the biggest barriers: the price swings of Bitcoin are large. If your income or savings can vary in worth by 10%, 20%, or more during brief periods of time, most will be reluctant to use it for day-to-day business.

- It jeopardizes its application as a medium of exchange: Individuals will hold off on spending if they anticipate value to appreciate, which can create deflationary pressures.

- Debt in Bitcoin form could turn dangerous: Governments or companies borrowing money could find themselves, at a moment’s notice, having to pay back money with much greater volatility than anticipated.

B. Scalability and Transaction Speed

Bitcoin on its base layer can only process a limited number of transactions per second. A global currency—every payroll, every payment, every day transaction—that needs to scale exponentially. Layer‐2 solutions, off‐chain scaling, or some other technological innovation would have to evolve dramatically.

C. Energy & Environmental Concerns

Bitcoin utilizes Proof‐of‐Work (PoW), which is energy intensive. If used globally, energy demands would be astronomical, raising moral and environmental issues. Grid stress, green house gas emissions, geospatial disparities in energy delivery all matter.

D. Loss of Monetary Policy Tools

Governments would lose monetary policy tools:

- No longer inflationary levers (quantitative easing) to respond to crises.

- No determination of interest rates to promote or rein in economies.

- In times of recessions or deflationary pressures, governments might be left without useful tools for managing demand.

E. Inequality & Wealth Concentration

- Early adopters and proprietors would benefit. Those without Bitcoin or crypto access might be disadvantaged.

Poor digital infrastructure nations would lag behind.

- The digital divide—internet connectivity, reliable electricity, secure hardware—would widen inequality.

F. Regulatory, Legal, and Governance Headwinds

Governments dislike relinquishing control. They will prohibit, overregulate, tax.

Legal status across jurisdictions would be unequal. Criminal use, fraud, money laundering problems.

Who has control of changes to the Bitcoin protocol? Conflicts may exist over forks, protocol enhancements.

G. Security and Loss Risks

Loss of private key = loss of money.

Hacking, scams, wallet/exchange weakness.

Digital theft would be a massive risk with no strong global safeguards.

Economic Dynamics: How Would the World Change If Bitcoin Becomes the World’s Currency?

Let’s take a step back: beyond individual risks and rewards, what economic, system-wide adjustments could occur?

A. Deflationary Pressure

Constant money supply and rising economy/population, Bitcoin will experience deflationary pressures: rising goods/services but constant money supply = prices may drop in the long run.

- Nice in certain aspects (more buying power over time), but bad for economic growth since everybody will wait to spend.

- Increases burden of debt in real terms (debts in BTC constant become unaffordable if incomes fail to grow aggressively).

B. Shift in Geopolitical Power

- Current reserve currency issuers (US, EU) would find some influence diminished.

- New influence hubs would arise based on nations with strong digital infrastructure, mining capacity.

- First-mover or early-adopter nations would have disproportionate influence.

C. Trade Patterns and Contracts

- Cross-border trade contracts denominated in BTC; commodity and energy markets redistribute.

- Import/export cost becomes more certain (no exchange‐rate risk), potentially increasing trade in some corridors.

- Weaker economies can experience higher exposure to world price cycles in Bitcoin.

D. Inflation, Interest, Fiscal Policy Movements

- Government fiscal policy comes into the forefront relative to monetary policy. You can’t inflate the debt away, so you tax, spend, and borrow.

- Interest rates might be determined globally or market‐based rather than national central bank discretion.

E. Financial Markets & Investment Behavior

- Bitcoin is the anchor of value, portfolios are expressed in terms of BTC.

- Other assets (stocks, bonds, commodities) increasingly valued against BTC.

- Risk management, hedging behavior shift: policies adapt to respond to Bitcoin volatility and supply dynamics.

Historical Analogies & Lessons

History can provide insight into what to expect.

- Gold Standard Period: during the 19th and early 20th centuries, most economies employed gold as money/standard. Gold shortage, transportation cost, unchanging supply—some advantages to discipline, several drawbacks when economies require flexibility.

- Currency Unions: Eurozone, for instance: common currency but not common fiscal policy generated tensions (e.g., Greece). Equilibrium between centralized monetary policy and decentralized fiscal policy is a sensitive balance.

- Hyperinflation Examples: Zimbabwe, Venezuela demonstrate what non-intervention on supply of money leads to. A global Bitcoin standard would prevent it theoretically—but by losing the means to intervene.

Transition: Is It Even Possible for Bitcoin Becoming World’s Currency?

Even if we think that individuals want it, is global Bitcoin transition possible?

A. Technical & Infrastructure Requirements

- Reliable broadband/internet everywhere.

- Secure digital wallets, hardware security.

- Layer‐2 scaling (think Lightning Network etc.) to facilitate micropayments on a daily basis.

- Energy infrastructure to facilitate mining and verification in an environmentally‐friendly way.

B. Legal & Regulatory Harmonization

- Harmonized regulation of digital assets, money laundering, taxation.

- Cross‐border regulation for consumer protection.

- Dispute resolution in smart contracts / atomic swaps / global trade.

C. Social & Cultural Shift

- Trust: People need to be able to trust Bitcoin already works, is fair, is stable enough.

- Education: Digital literacy, risk comprehension.

- Financial behavior shifts: saving behavior versus spending behavior, tolerance of volatility.

D. Political Will & Resistance

- Governments and central banks stand to lose much. Numerous governments will object to losing control over the currencies.

- Current financial institutions will struggle against regulatory loss of advantage.

- Fragmentation is a possibility: some nations take up, others don’t → dual systems, tensions.

Scenario Sketches: What Could Happen in Practice

To make this more tangible, let’s consider a few possible future scenarios.

Scenario A: Gradual Global Integration

- Several countries begin adopting Bitcoin as legal tender, especially those with weak fiat systems.

- Cross-border trade arrangements increasingly cited in BTC.

- International reserve portfolios increasingly include more Bitcoin.

- Decades hence, Bitcoin is one of a few dominant currencies; fiat systems shrink but don’t disappear overnight.

Scenario B: Sudden Disruption

- Crisis (shocking inflation, breakdown of trust in one of the dominant fiat currencies) forces many to leap into Bitcoin hastily.

- Lightning Network or alternatives scale phenomenally, making small transactions cheap and fast.

- Some governments fail; others aggressively limit fiat printing. Bitcoin steps in.

Scenario C: Fragmented Global Currency

- Some states adopt; others do not. Two-tier world of currency: Bitcoin zones and fiat zones.

- Cross‐border friction remains between zones.

- Digital infrastructure control becomes geopolitics asset.

What It Would Mean for Key Stakeholders If Bitcoin Becomes the World’s Currency

Individuals

- Advantages: More control over savings; possibility of protection from inflation losses; access to global markets; opportunities for wealth creation.

- Disadvantages: Exposed to volatility; possibility of losing private keys; no comeback if it does not work; possibility of disparity (people with earlier access gain most).

Businesses

- Have to manage exchange risk less (if wholly international), but volatility risk remains.

- Price stability is crucial: contracts, wages, cost of goods.

- Infrastructure investment: infrastructure needs to support Bitcoin payments; accounting, compliance, legal issues.

Governments & Central Banks

- Lose or lose substantial functionality of instruments like quantitative easing, interest rate manipulation, currency devaluation.

- Fiscal policy comes to the forefront: taxation, spending, debt management.

- Need to regulate heavily: consumer protection, blocking criminal uses, ensuring energy costs, infrastructure integrity.

Global Institutions

- Institutions like IMF, World Bank, WTO would need to realign frameworks built around fiat currencies.

- New reserve backing; perhaps new finance instruments denominated in Bitcoins.

- Geopolitics would likely shift: countries with large Bitcoin reserves, mining capacity, or early adoption gain strategic influence.

Trade‐Offs: What Are We Giving Up?

No free lunch. To reap the benefits, society will have to make some trade-offs.

- Flexibility vs Discipline: You gain discipline in monetary supply; you sacrifice flexibility to respond in a crisis.

- Stability vs Risk: Volatility will always pose a risk factor. Some stability would be compromised for decentralization and exposure.

- Environmental & Energy Costs: Must either accept high energy usage or seek cleaner consensus mechanisms.

- Inequality: Early recipients, developed economies benefit more; digital divide is exacerbated.

Could It Be Better Than Alternatives?

As we consider Bitcoin as an international currency, one should compare with alternatives or hybrid solutions:

- Central Bank Digital Currencies (CBDCs): Government-issued digital money can offer much of the efficiency of Bitcoin but under state control.

- Stablecoins (Asset-backed or multi-fiat backed): Can offer price stability, then trust & backing are important issues.

- Baskets of Currencies: World unit pegged to multiple fiat currencies (like IMF’s Special Drawing Rights) — lower volatility, still state-controlled.

Bitcoin’s uniqueness is decentralization, scarcity, censorship resistance. The question is whether these are worth the trade-offs to these alternatives.

Ethical, Social, Environmental Concerns If Bitcoin Becomes the World’s Currency

- Access & Equity: Giving individuals in remote or developing regions access to technology, internet, safe devices.

- Environmental Impact: Lots of energy is consumed by mining. If global, that’s a significant burden. Need to have renewable energy or re-design consensus.

- Privacy & Surveillance: Bitcoin is pseudonymous, yet public ledger means that transactions are traceable. Privacy fears, abuse of data may happen.

- Governance & Protocol Disputes: Who gets to decide upgrades, forks, basic changes? Conflicts could lead to fragmentation.

What Could Prevent Bitcoin from Becoming a Global Currency

Let’s flip the question: why might Bitcoin never become the global currency?

- Technical limitations: Scalability, transaction throughput, energy consumption.

- Regulatory crackdowns: Governments banning or severely curtailing use.

- Disagreement: On protocol changes, on regulations, on how to integrate with existing systems.

- Risk-aversion of individuals: Most prefer stable, known fiat currency. Volatility scares businesses, people.

- CBDCs & other digital assets competition: Governments can build their own better digital money.

- Cultural resistance: Local currency, local institutions, national identity all tied to monetary sovereignty.

Vision vs Reality: What Would a Mid-Term Path Look Like

If we believe global adoption of Bitcoin is possible, here’s a plausible timeline on maybe 10-30 years:

- Pilot Programs & Legal Tender Transitions

A handful of countries with poor fiat systems institutionalize Bitcoin on an official basis (such as El Salvador attempted). More parliaments pass laws sanctioning or mandating its use in certain sectors. - Institutional Adoption & Reserve Integration

- Major central banks buy Bitcoin into reserves; major companies price some transactions in Bitcoin; ETFs and investing products mature.

- Improved Infrastructure

- Scaling solutions are efficient, fast, cheap. Energy consumption reduces or goes green. Wallets, security, interface become much improved.

- Regulatory & Legal Harmonization

- Global rules for trading, taxation, anti-fraud, dispute resolution arise. Maybe treaties or agreements.

- Cultural & Behavioral Change

- People get used to paying with Bitcoin in their daily lives. Savings/investment habits alter. Financial, digital literacy spreads.

- Global Standardization

- Bitcoin is now one of the world’s leading currencies; perhaps some local fiat currency still exists, but for global trade & finance Bitcoin is preeminent.

Open Questions

The following are some open questions to consider. These are the kinds of questions we do not yet have good answers to:

- What would be the effect in the event of a great economic crisis when individuals crave liquidity and governments lack the ability to print money?

- How would interest rates globally be set, and by whom?

- How to deal with deflationary pressure and encourage productive investment?

- How might the environmental cost of Bitcoin be regulated or offset?

- Would there be a fork: multiple versions of Bitcoin or competing protocols, ruining the idea of one world money?

Conclusion: Revolution or Recklessness

Bitcoin as a global currency is not just a technical question; it is a philosophical one. It forces us to ask what we value most in money: stability, freedom, trust, or control.

Supporters argue that Bitcoin would mark the beginning of a new era—an era where money is neutral, untouchable by politics, and accessible to anyone with an internet connection. It would be the ultimate equalizer, breaking down barriers of geography and unfair advantage built into today’s financial system.

Critics warn it could unleash instability on a scale we’ve never seen. Entire economies could be held hostage by sudden price swings. Governments might find themselves powerless in crises, unable to print or inject liquidity when their people need it most.

What’s clear is that if Bitcoin ever reached this stage, the shift wouldn’t be purely financial. It would transform politics, trade, culture, and even human psychology. A single, global, decentralized currency would demand new ways of thinking about sovereignty, cooperation, and governance. In many ways, it would test whether humanity is ready for a system where trust is placed in code and mathematics rather than central authorities.

Call to Discussion

- Would you be comfortable accepting payments in Bitcoin every month, with no fiat option?

- Do you think governments would ever voluntarily give up control of money?

- How can developing nations ensure that they don’t fall farther behind in such an evolution?

- Is there a hybrid model which considers the best of Bitcoin and fiat economies?

You can also read: What is cryptocurrency and how does it work?